How to pay your Portuguese taxes from abroad

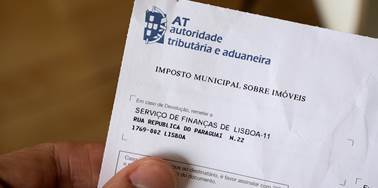

It is now possible to pay your Portuguese taxes, IMI (property council tax), car taxes etc. from abroad and you don’t need a Portuguese bank account to do it.

If you are abroad or when you live in a foreign country, you have two options to pay your taxes: Direct debit or Bank transfer. Make sure you pay them in time as it is not possible to pay overdue taxes.

HOW TO PAY TAXES FROM ABROAD

Click here to access the instruction manual provided by the Finance department in Portuguese, English and French. (If you are unable to open the instructions, they are below).

Paying your Portuguese taxes from abroad where never easier. But It is now possible to pay your Portuguese taxes, IMI (property council rates), UCI (car taxes) etc. from abroad and you don’t need a Portuguese bank account to do it.

If you are abroad or when you live in a foreign country, you have two options to pay your taxes: which are by Direct debit or Bank transfer. - Make sure you pay them in time as it is not possible to pay overdue taxes.

You have two options to pay your taxes: Direct debit or Bank transfer

1) If you choose for bank transfer,

Please provide your bank with the information set out below so that the bank, when carrying out the transfer, could send such information to Tax Administration, as it is essential for the identification of the payment:

You just need to make a transfer from your bank with the following information:

- Your Portuguese fiscal number / "Identificação Fiscal" - (located in the lower left corner of your invoice unther the title "Identificação Fiscal" )

- The reference number for payment /“Referencia para Pagamento" - (located in the bottom left corner of your invoice)

To the following account:

Creditor´s name: Autoridade Tributaria e Aduaneira

Bank account number: 83 69 27

IBAN: PT50 0781 0019 00000008369 27

Bank Name: Agência de Gestão da Tesouraria e da Dívida Pública – IGCP, E.P.E.

SWIFT Code: IGCPPTPL

Please note:You must make a bank transfer for each payment document. The payment is recommended to be made at least 2 working days before the deadline.

2) If you choose direct debit:

The IBAN of the account you want to use for payment must be domiciled with a bank located in a country of the Single Euro Payment Area (SEPA). SEPA countries are: The Member States of the European Union, Andorra, Iceland, Liechtenstein, Monaco, Norway, San Marino, Switzerland and the Vatican City State.

Plese Note: To pay a given amount by direct debit, whose deadline expires in a specified month or on the first working day of the following month, you must have completed the sign up process before the 15th of that month (or on day 10 in the case of instalment payments). The accession procedure is recommended to be initiated 5 working days before the deadline referred to above.

Click here for an overview of the Portuguese Tax System and useful forms

NOTE: "The information provided on this page is for informational purposes only and does not constitute professional, legal, financial or other advice. Although we strive to keep the information up to date and correct, we do not guarantee its accuracy, completeness or timeliness. The use of the information provided is the sole responsibility of the user."